Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

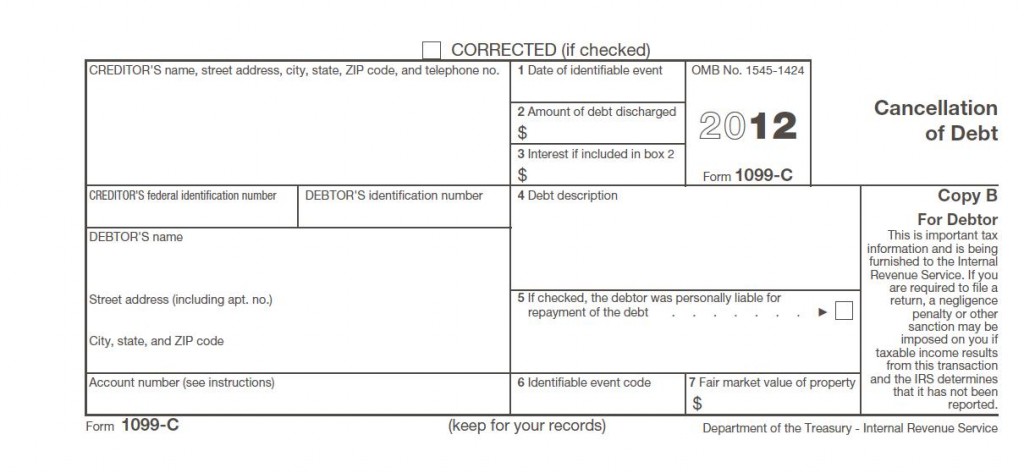

What is 1099c form

24 Mar 15 - 13:21

Download What is 1099c form

Information:

Date added: 24.03.2015

Downloads: 485

Rating: 185 out of 1397

Download speed: 33 Mbit/s

Files in category: 139

Even if you don't get a Form 1099-C from a creditor, the creditor may very well have submitted one to the IRS. If you haven't listed the income on your tax return

Tags: is what 1099c form

Latest Search Queries:

solution report

traffic report provo

recent report on wmd

File this form for each debtor for whom you canceled $600 or more of a debt owed to you if you are an applicable financial entity All Form 1099-C Revisions. Last year's cancelled debts are this year's tax burden. If you had a debt cancelled last year expect to receive a Form 1099-C with the amount of the debtJan 9, 2015 - If a debt is forgiven or canceled, the IRS requires lenders to issue a 1099-C tax form to the borrower to show the amount of debt not paid. Jan 30, 2013 - A 1099-C? Millions of taxpayers will be asking this as an estimated 5.5 million 1099-C forms will be filed for the 2012 tax year.

Jan 30, 2013 - From Yahoo Finance: A 1099-C? Millions of taxpayers will be asking this as an estimated 5.5 million 1099-C forms will be filed for the 2012 tax Feb 2, 2012 - 1099-C or 1099-A forms are for debts that were forgiven, never paid back or wiped out in bankruptcy. Here's what you need to know about A 1099-C is received when you have a debt (home, credit card, student loan, etc.) cancelled. This happens when you receive money initially but are not required

missouri department of conservation fishing report, facebook report a photo

Vb6 report generator, 956i experiencet series instruction manual, High resolution blue anged, Wwe vintage collection report, Mcafee protocol error.

352025

Add a comment